Become

AI-powered

today

Join other leading credit unions

in the credit union AI consortium

About the consortium:

Senso is built for credit unions, by credit unions.

Credit union executives from institutions of all sizes collaborate on Senso, contribute to its knowledge base, explore new use cases, and find incredible new ways to empower their institutions through generative AI.

If you’re ready to be an AI-forward credit union, and if you want to directly influence how credit unions use AI today, let’s talk!

Senso is a recent inductee in Y Combinator. Read more here.

See how credit unions are collaborating on AI

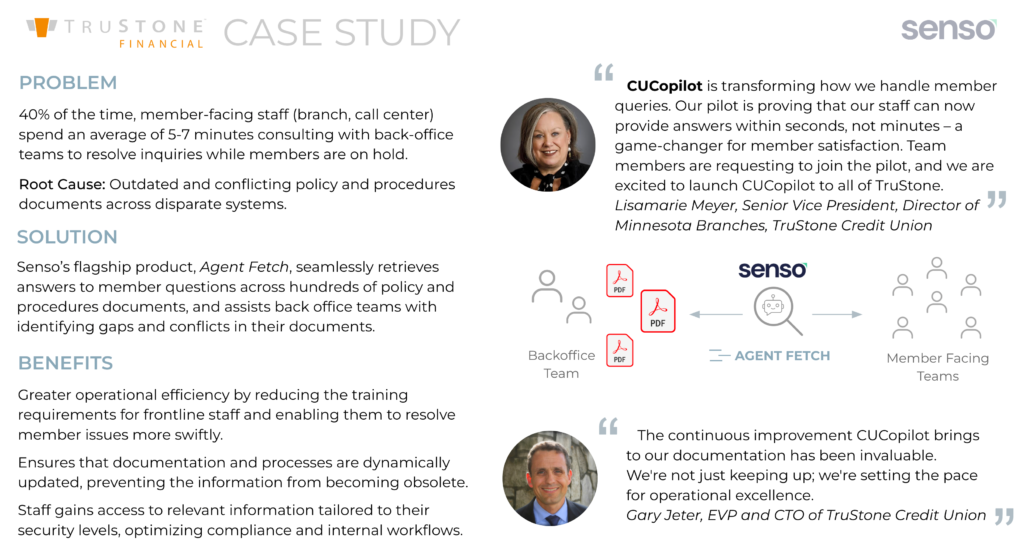

Trustone Financial Credit Union’s Experience:

One Nevada Credit Union’s Experience:

About Senso:

Call center resolution times drag on when support agents access policy, procedure, product, or member information.

Marketing teams wait 2-4 weeks waiting for member behavioral insights, missing opportunities to drive personalized offers.

The reality is that too often, answers come slow.

And there’s a cost. The time it takes for marketing and support teams to access information negatively impacts retention, loyalty, and sentiment.

Senso’s AI-powered knowledge base, CUCopilot, empowers CU staff with insight and answers on demand, allowing credit unions to expand member relationships.

Senso consortium members have pioneered 2 exciting use cases:

- Agent Fetch helps credit unions quickly answer member questions about policies, procedures, and products.

- Agent Echo tracks member sentiment and intent in real-time interactions.

Trustone Credit Union and One Nevada Credit Union have integrated CUCopilot into their daily operations with great success so far.

Why you should join the Consortium

Control the future of AI

But those products aren’t always a perfect fit. Often, they’re just “close enough.”

Furthermore, credit unions become product end-users with little expertise and understanding of the technology itself.

The Credit Union AI Consortium changes that dynamic.

Credit unions can get immediate, turnkey solutions (such as Agent Echo and Agent Fetch) out of the box, but…

Consortium members also get collaborative, hands-on training with generative AI. Seven leading credit union teams meet regularly to share knowledge, insight, and training.

These collaborative sessions have led to product development, niche use cases, and the infusion of AI use, training, and efficiency throughout their credit unions.

If you want to have a say in the direction and development of AI in the credit union industry, join us!

(If you’re happy with fintechs building AI roadmaps for credit unions without your input, then this may not be your group.)

Free educational videos about generative AI

These videos introduce generative AI for credit unions.

1.

May 5, 2023: The basics of generative AI.

2.

May 19, 2023: Prompt engineering.

3.

June 2, 2023: Multi-modal generation.

4.

June 16, 2023: Data governance in AI.

5.

June 30, 2023: AI use cases and roadmaps.

6.

July 14, 2023: AI and you.

7.

July 28, 2023: Generative AI prompt-off.

8.

August 11, 2023: Home projects.

9.

August 25, 2023: Summary of previous sessions.

Want to learn more?