Buy Now, Pay Later (BNPL) and Credit Unions

Buy Now, Pay Later (BNPL) is the biggest payments trend that credit unions aren’t using. That needs to change ASAP.

5 Common Mobile UI/UX Mistakes in Credit Union Apps (with Examples)

Have you heard of the Dunning-Kruger Effect? It describes a tendency for people to misevaluate their own knowledge or competence on a subject. Experts underestimate themselves—and for laypersons to assume they know way more than they do.

Improving Credit Unions Rewards Programs

Like most Americans, I use rewards cards almost exclusively. Whether cash back, travel perks, or discounts at national and local businesses, I some of the money I spend to come right back to me.

Investment Accounts for Kids: Where Credit Unions Fit In

Don’t work at a credit union, but like what you see? Head to UNest to open an investment account for your kids today! Most of my friends and I are so close to 40 that it looks blurry now. Most of us have kids (I don’t) and multiple app-based investment accounts (I do). Naturally, there’s […]

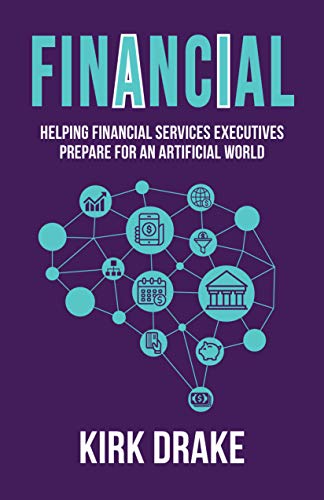

AI Case Study: QCash

This is an excerpt from FinAncIal: Helping Financial Executives Prepare for an Artificial World. Grab your copy here! This case study covers the leading player in AI-based small-dollar lending for credit unions, QCash. Stay tuned to the CU 2.0 blog while we feature more excerpts from our financial guide to AI! Purveyors of short‑term credit and small‑dollar […]

AI Case Study: Digital Onboarding

This is an excerpt from FinAncIal: Helping Financial Executives Prepare for an Artificial World. Grab your copy here! This case study covers the leading player in AI-based digital onboarding for credit union members, Digital Onboarding.

AI Case Studies: FlexPay

This is an excerpt from FinAncIal: Helping Financial Executives Prepare for an Artificial World. Grab your copy here! This case study covers the leading player in AI-based decline salvage for fraud prevention, FlexPay.

AI Case Studies: Posh Technologies

This is an excerpt from FinAncIal: Helping Financial Executives Prepare for an Artificial World. Grab your copy here! This case study covers the leading player in AI-based credit union chatbots. Posh Technologies’ conversational AI includes capabilities for web, SMS, social, mobile, IVR, and home digital assistants, such as Amazon Echo and Google Home. Stay tuned […]

AI Case Study: Grain Technologies

This is an excerpt from FinAncIal: Helping Financial Executives Prepare for an Artificial World. Grab your copy here! This particular case study was cut for space from the book. However, the book features more than a dozen explorations of AI-based fintechs. Stay tuned to the CU 2.0 blog while we feature more excerpts from our financial guide to AI!

CU 2.0 Podcast Episode 135 Joel Schwartz DoubleCheck and NSF Fees

Overdraft fees are big business for most financial institutions and it’s estimated that 20% of credit union members, one in five, have an NSF annually. The worse news is that the credit union’s NSF fee is just the start of the consumer’s pain. Joel Schwartz, founder and co-CEO of DoubleCheck, a Los Angeles company with an […]