A Survey Schedule for Credit Unions

Credit unions have many advantages over banks. But you know that, of course. And yet sometimes, especially when community banks offer better rates somewhere, or when big banks have better credit card rewards, it can be hard to remember the intangibles that credit unions offer.

CU2.0 Podcast Episode 112 Steve Bruyn on the Huge Opportunity For Credit Unions to Win Bank Customers Today

You remember Bank Transfer day, that 2011 movement that brought in perhaps one million new credit union members, possibly more. Something a lot bigger may be about to happen. That’s the opinion of Steve Bruyn, CEO of Foresight Research who, writing in The Financial Brand, said that its extensive polling had found nearly a doubling of the number of […]

Choosing Credit Union–Fintech Partnerships

Let’s get one thing clear: Credit unions are generally not known for their technology. It’s rarely the most innovative, convenient, or user friendly. In many cases, credit union technology is years (sometimes many!) behind competitors.

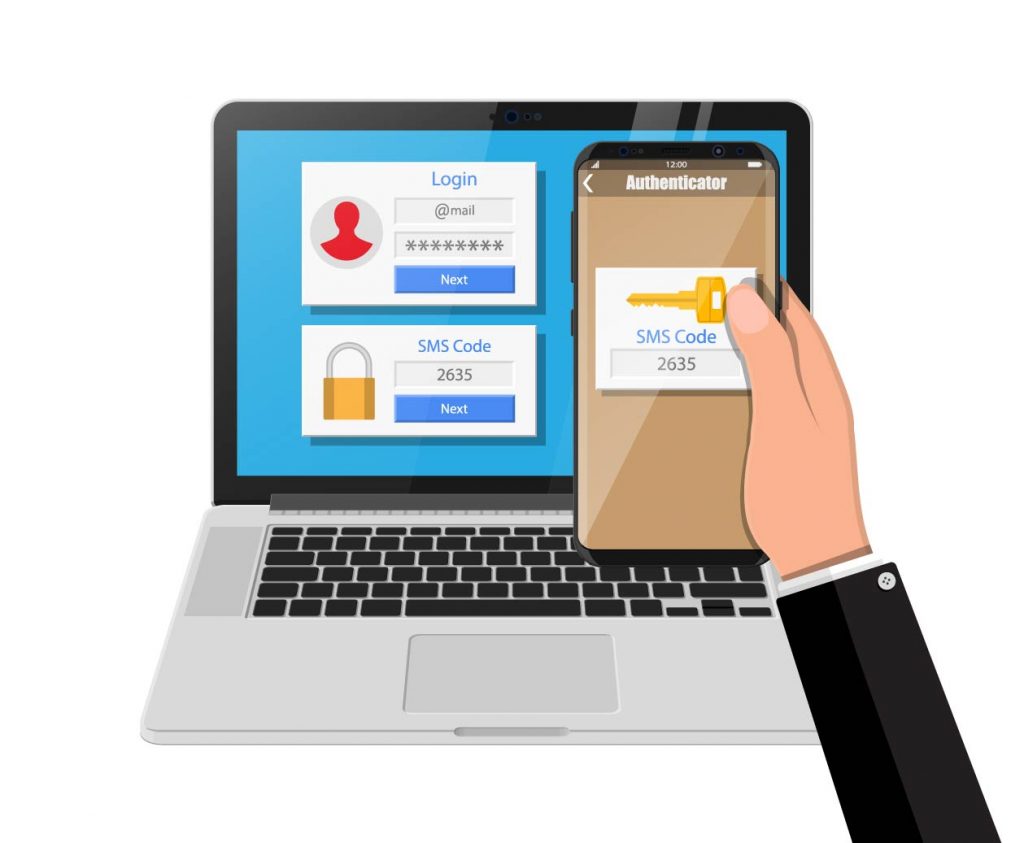

Does Your Credit Union Use Text-Based Two Factor Authentication?

One of the most important tools that credit unions have to manage identity is two-factor authentication (2FA). Most credit unions and financial institutions have something like 2FA in place. But not all 2FA solutions are created equal.

CU2.0 Podcast Episode 111 The Omnichannel Voyage, Part 2 with Mark Schuiling of Wildfire Credit Union

No more cookie cutter solutions. And put a branch in the member’s hands with mobile tools that allow the member to do pretty much anything he/she could do in a branch. When Wildfire, a $900 million credit union in Saginaw Michigan, set out on its omnichannel journey four or five years ago it dreamed big, […]

The Nation’s Eviction Crisis and Credit Unions

The Aspen Institute throws out a startling number of how many evictions we may see when the CDC’s eviction ban expires at year-end. Says the think tank, “According to the latest analysis of weekly US Census data, as federal, state, and local protections and resources expire and in the absence of robust and swift intervention, […]

Is That Chatbot for Credit Unions Really AI-Powered?

Let’s be clear: the COVID-19 crisis has drastically increased consumer demand for chatbots. They keep you connected to your members while helping them with mundane issues like password resets, fee disputes, and minor banking needs.

CU 2.0 Podcast Episode 110 The Omnichannel Voyage, Part 1 with Vince Bezemer of Backbase

For how many years have you heard about omnichannel banking – and you also know not many institutions have done this more than pay lip service to an idea of the digital first financial institution.

Credit Unions Should Learn from the Rebirth of Retail

Last week I made a breakthrough in my relationship with my wife. We have been married 16 years and she finally felt secure enough to tell me something I have known for years. Kirk, she said, you are not a very good dresser. Frankly, most of the time you look like Ted Kennedy and Rodney […]

How to Be a Borrower-First Mortgage Servicer

Taking out a home loan is a big step for anyone. As a credit union, you provide personal, community level service that other financial institutions can’t. You probably want your members’ mortgage lending experience to feel as personal as the rest of your interactions.