The Truth About 99.999% Telephone Uptime

Most major telecom providers strive for high availability on their lines. They know that businesses require open communications lines to succeed. Any downtime at all could result in dissatisfied consumers or loss of revenue. So, they offer 99.999% uptime. Especially now, with COVID-19 spreading across the country, people need reliable phone service. Conference calls on […]

CU 2.0 Podcast Episode 82 Jon Ogden MX on the Future of Banking

Does your credit union have a future? There’s the blunt question. Welcome to the CU2.0 Podcast with your host Robert McGarvey. Today’s guest Jon Ogden, head of strategic content at digital firm MX which has recently released two provocative reports, The Ultimate Guide to the Future of Banking and the Ultimate Guide to Digital Transformation. Read them, they […]

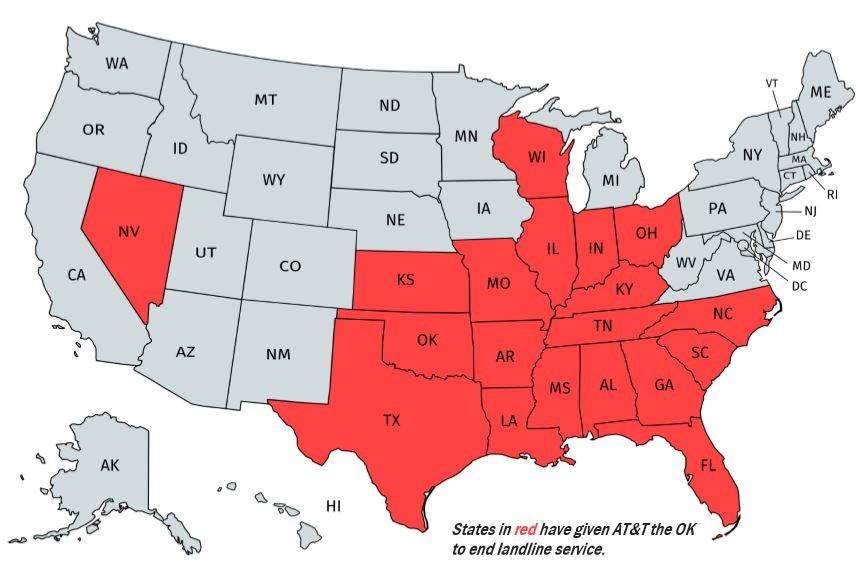

Copper Lines (POTS) May Soon Go Extinct

Here’s something you may not have known: copper telephone lines are going extinct. In fact, top U.S. carriers like AT&T and Verizon have already outlined plans to discontinue copper landline service in nearly half of the U.S. And those plans were approved in 2017. The reality is that copper lines are expensive to install and […]

What Are Memes? And Why Should Credit Unions Care?

If you’ve been living under a rock for the last decade, you may have missed it. An astounding amount of social media content and interaction revolves around memes. But what are memes? Are there examples of memes? And why should credit unions care about them? Because, let’s be honest here, credit unions should care about […]

CU 2.0 Podcast Episode 81 Keith Leggett and Bank-Credit Union Mergers

When a credit union buys a community bank is that dancing with the devil? Welcome to the CU2.0 podcast with your host Robert McGarvey. Today’s guest Keith Leggett, now retired Chief Economist with the American Bankers Association who still actively writes his blog, Credit Union Watch. The topic of the talk: bank – credit union mergers. […]

Is Zoom Safe for Credit Unions?

Almost every business where employees can work remotely have shuttered brick and mortar operations. Even credit unions have been closing their branches to prevent the spread of the COVID-19 pandemic. As organizations move to remote work, they’re moving to Zoom’s video calling to stay connected. But is Zoom safe for credit unions?

CU 2.0 Fintech Friday: iink Endorsements

It’s CU 2.0 Fintech Friday! Today, Chris Otey sits down with iink Endorsements to discuss all things credit union, fintech, and digital innovation. This series is meant to introduce potential partners and vendors to your credit union. We won’t highlight any fintech foes or digital distractions for your credit union’s CEO! iink Endorsements for Insurance […]

Responsible Lending Options and Member Financial Health

If you make a good salary and feel comfortable with your job security, then you’re very much in the minority in America. For most, the American dream is just that: a dream. The fact is that nearly 4 in 5 people are living paycheck to paycheck right now.

CU 2.0 Podcast Episode 80 Scott Petry Authentic8 on the Tower of Babel in Many FIs

They just don’t talk well together. That’s the surprising conclusion in a report entitled “Surprising Disconnect Over Compliance and Secure Web Use at Financial Firms,” research sponsored by IT security company Authentic8. (Download the report here.) Inside many banks and credit unions IT, compliance, and legal just don’t talk the same language and often do not […]

What Brands Need Now Is Compassion Marketing

I’m not much of a crier. Last week I had a breakdown. I couldn’t stop thinking of all the lives this pandemic has affected—and cut short. I know I’m not alone here. All over the world right now, people are struggling. Many are laid off and can’t make rent. Some might lose houses. Others are […]