CU 2.0 Podcast 51: Marc Schaefer Truliant

Welcome to episode 51 of the CU 2.0 Podcast. Can a credit union serve more than one employer group? You know what today’s answer is of course. But to know the history you need to talk with Marc Schafer, CEO of Truliant, a Winston Salem credit union. That’s because Truliant was sued by a banker’s […]

CU 2.0 Podcast 49: Alain Glanzman WalletFi

Welcome to episode 49 of the CU 2.0 Podcast. Take a guess. How many recurring payments does a typical consumer have set up, for how much money monthly? Alain Glanzman, CEO of fintech WalletFi is focused on exactly that issue – and also on the huge potential it represents for credit unions.

CU 2.0 Podcast 48: Susan Mitchell on the Credit Union Underground

Welcome to episode 48 of the CU 2.0 Podcast. Circle the date, October 26. Las Vegas. That’s when Susan Mitchell, a longtime credit union consultant, is convening another meeting of the Credit Union Underground, this time in parallel with Money 20/20, probably the meeting of the best and brightest in the disruptive quadrant of financial services.

CU 2.0 Podcast 47: Randy Karnes CU*Answers for Small Credit Unions

Welcome to episode 47 of the CU 2.0 Podcast. Randy Karnes just may be the poster boy for the cooperative entrepreneur. In the process, he may also have come upon the formula that will enable many hundreds – perhaps thousands – of small credit unions to thrive in the 21st century.

Are You Attending CUNA Tech & OME This Year?

Are you attending this year’s CUNA Technology & OME Conference this September in Chicago? Don’t miss the CU 2.0 Fintech Happy Hour. Email info@localhost to reserve your spot today! Click here to see what other CU 2.0 events are coming up.

CU 2.0 Podcast 46: Kirk Kordeleski on Doubling Your Size and More Good News

Welcome to episode 46 of the CU 2.0 Podcast. In this podcast, Kordeleski tells why this is a time of immense, perhaps unprecedented opportunity for credit unions. Use digital and use data to allow your institution to expand in ways that a generation ago would have been unimaginable.

Credit Union 2.0 Podcast 45: Gary Oakland BECU

Welcome to episode 45 of the CU 2.0 Podcast. In this podcast, you will hear his recipe for credit union success. Call this the credit union oral history sequence – Blaine, Bucky Sebastian, now Gary Oakland who took over BECU, with around $700 million in assets, in the mid-1980s and when he left in 2012 […]

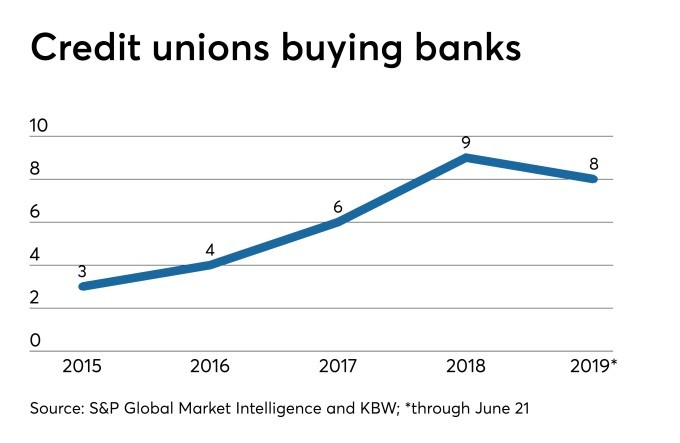

Credit Unions Buying Banks: Good, Bad, or Plain Ugly?

Eight times so far this year a credit union has bought a bank, according to Credit Union Times’ count. Some deals are small – Verve, for instance, paid $43 million to buy South Central Bank in Chicago. Some are bigger such as Arizona Federal Credit Union’s buy of Pinnacle Bank in Scottsdale with its $236 […]

Credit Union 2.0 Podcast 44: Wendell “Bucky” Sebastian – a Credit Union Life

Welcome to episode 44 of the CU 2.0 Podcast. In this podcast, you’ll hear what killed off savings and loans and why credit unions escaped their fate, why community banks may be next to expire (and what may keep them alive), and the big advantage credit union CEOs have over their peers at banks. A […]

Credit Union 2.0 Podcast 43: Caroline Willard Cornerstone League

Welcome to episode 43 of the CU 2.0 Podcast. Today is all about what credit unions need to do to survive and what leagues need to do. Cannabis banking. Data breaches. Taxation of credit unions. The disappearance of small credit unions. The rise of $10 billion+ credit union behemoths. Welcome to the world of Caroline […]