The Effect of Returned Mail at Credit Unions

2.5% of all First-Class Mail® is returned. That may not seem like a significant amount. I assure you that it is. In the volume that credit unions send statements, notices, forms, and other documents, thousands of envelopes may be returned each month.

Financial Wellbeing Starts with the Car Loan and Doesn’t End There

According to the Bureau of Labor statistics, transportation expenses are the second largest discretionary spending in a consumer’s budget. The industry is so large, it’s one of the few nationwide ‘trillion dollar’ industries. (Healthcare, food, and housing are the other three.)

3 Ways to Improve Your Digital Member Experience

In the early days of the pandemic, researchers were already hard at work. They wanted to see the effect our socially-distant lifestyle had on banking. Some of their findings were alarming—even though they’re right in line with what we expected.

A Survey Schedule for Credit Unions

Credit unions have many advantages over banks. But you know that, of course. And yet sometimes, especially when community banks offer better rates somewhere, or when big banks have better credit card rewards, it can be hard to remember the intangibles that credit unions offer.

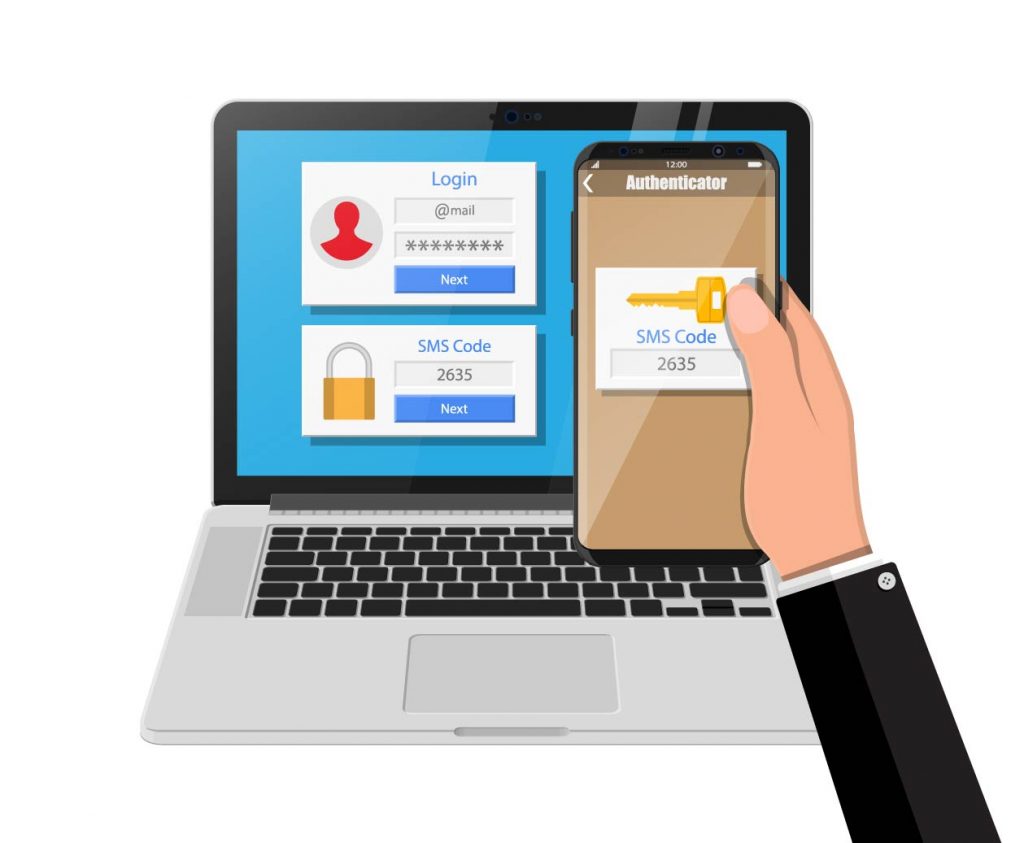

Does Your Credit Union Use Text-Based Two Factor Authentication?

One of the most important tools that credit unions have to manage identity is two-factor authentication (2FA). Most credit unions and financial institutions have something like 2FA in place. But not all 2FA solutions are created equal.

Is That Chatbot for Credit Unions Really AI-Powered?

Let’s be clear: the COVID-19 crisis has drastically increased consumer demand for chatbots. They keep you connected to your members while helping them with mundane issues like password resets, fee disputes, and minor banking needs.

How to Be a Borrower-First Mortgage Servicer

Taking out a home loan is a big step for anyone. As a credit union, you provide personal, community level service that other financial institutions can’t. You probably want your members’ mortgage lending experience to feel as personal as the rest of your interactions.

Why Your Credit Union Needs Office 365

Most credit unions have been using Microsoft Office for years. But the legacy versions have been surpassed in efficiency by their successor. Office 365 is the new and improved version of the tried and true Microsoft programs. There is a big demand for businesses to undergo digital transformations.

What Does the Rise in Cashless Payments Mean?

A meme made its way onto Forbes a couple of months ago. Somehow, we didn’t see it until this week. But the content bears repeating here: Who led your digital transformation? CEO CIO COVID-19 In the meme, option C is circled. If you don’t get the joke already, let me ruin it by explaining it […]

Examination and Audit Checklist for Credit Unions

Has your credit union’s audit process been impacted by the COVID-19 pandemic? Do your findings take too long to clear? Does your team struggle to find and leverage past results?