Getting Your Data In Order – A Recipe for Credit Union Digital Transformation

Data is fundamental to your credit union digital transformation. Customers must be able to efficiently and effectively manage transactions online. Credit Unions must be able to infer customer needs from those transactions and reach out to customers where they “live” online, whether through email, social media, or text. This blog post presents a simple recipe […]

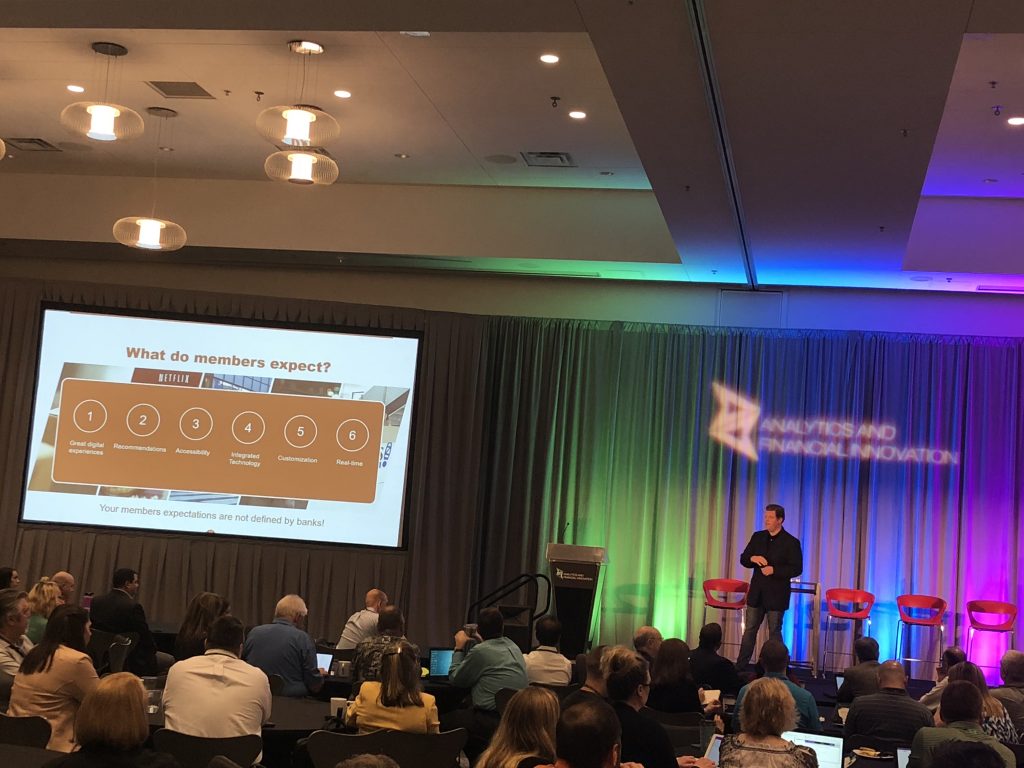

5 Lessons Learned from AXFI 2018

This week I had the honor of speaking at the 2018 AXFI (Analytics and Financial Innovation) Conference for Credit Unions in Minneapolis. I spoke on the Credit Union 2.0 DREAM methodology. First off, this is a great event that attracts an abundant group of Credit Union thinkers, innovators, and has truly great content. Here are […]

Credit Union Data Analytics: Who are your best members? :)

Our “A” members are the ones who know the difference between a credit union and a bank, believe it, feel it, and espouse it. They bring us all of their financial services business and tell all their friends. If you are interested in what their data tells you about them then this post in Credit […]

Credit Union Data Analytics: Who are your best members?

Our “A” members are the ones who know the difference between a credit union and a bank, believe it, feel it, and espouse it. They bring us all of their financial services business and tell all their friends. If you are interested in what credit union data analytics tells you about them then this post […]

Credit Union Data Analytics: How do you know your member is about to leave you? :(

If you work for a credit union and are looking for ideas on how to stem attrition or member loss, then this post is for you. This blog is part eight in Credit Union 2.0’s “Almost 99 Small Data Credit Union hacks” series and is based on the book Credit Union 2.0 – A Guide for […]

Credit Union Data Analytics: Wallet Share

We only have a couple of posts left – but don’t fret – we have saved some of our best content for the end of our Almost 99 Small Data Hacks for Credit Unions – Guide series. Today, we are covering how to gain wallet share for your credit union from data analytics. Who doesn’t want […]

Credit Union Data Analytics: Common Error Avoidance

Now that we are more than halfway through our Almost 99 Small Data Hacks for Credit Unions – Guide series, it is time to switch gears a bit. This post features hacks that are entirely focused on expense savings. One credit union I worked at would survey its members regularly. The common sentiment was that the […]

Survey Ideas for Members

Creating repeatable processes that allow your credit union to continuously adjust and recreate good experiences for your employees is essential for receiving social validation. Credit unions have lots of repeated interactions – swiping a credit card, going to an ATM, calling a call center, etc. Since financial services are commoditized and fungible, it’s not fair […]

Credit Union Data Analytics: Risk Awareness

As we continue the Credit Union 2.0 “Almost 99 Small Data Hacks for Credit Unions – guide” series, today we are covering risk items for internal consumption only. While many of our hacks are targeted at proactive marketing, these hacks are key insights you can gather internally from your member data. This is the fifth […]

Predictive Analytics for Credit Union: Member Limits

In the first several posts in this series, we covered key insights that can be gathered from address changes, payroll changes, and fees as part of our “Almost 99 Small Data Hacks for Credit Unions” series. Next up, we will dive into credit union services and limits that can sometimes negatively impact your relationship with […]