Constellation and the Next Stage of Digital Banking Platforms

We won’t bother linking all the statistics that support this statement: Digital banking is the front door to your digital branch.

5 Common Mobile UI/UX Mistakes in Credit Union Apps (with Examples)

Have you heard of the Dunning-Kruger Effect? It describes a tendency for people to misevaluate their own knowledge or competence on a subject. Experts underestimate themselves—and for laypersons to assume they know way more than they do.

AI Case Study: Grain Technologies

This is an excerpt from FinAncIal: Helping Financial Executives Prepare for an Artificial World. Grab your copy here! This particular case study was cut for space from the book. However, the book features more than a dozen explorations of AI-based fintechs. Stay tuned to the CU 2.0 blog while we feature more excerpts from our financial guide to AI!

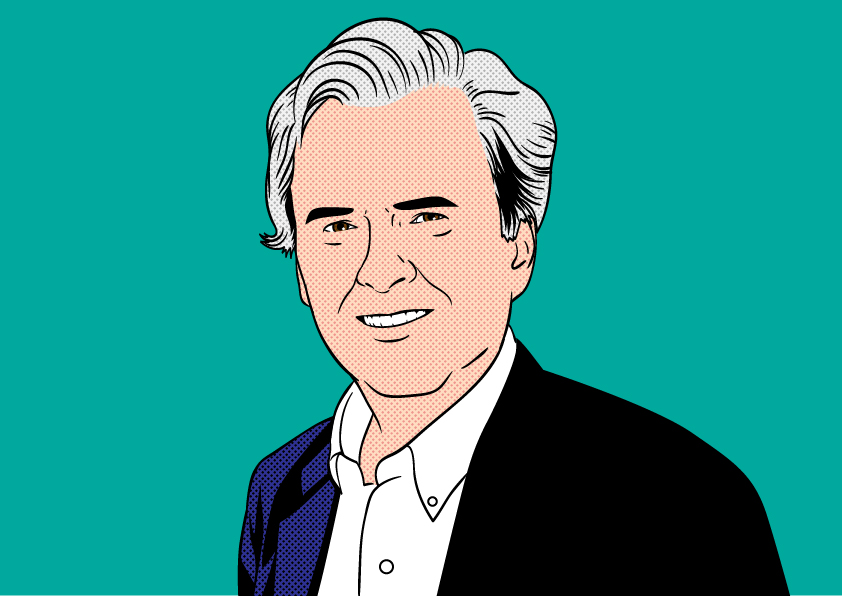

CU 2.0 Podcast 39: Futurist Chris Skinner

Welcome to episode 39 of the CU 2.0 Podcast. Today is all about the future of Credit Union digital banking. Consumers don’t want a digital bank. They want digital banking. That’s a building block belief of futurist-blogger Chris Skinner who has become a regular on the conference speaking circuit.

CU 2.0 Podcast: Series 15 – Cathie Mahon CEO of Inclusiv, the association of community development CUs

It’s the Credit Union podcast! CU 2.0 is excited to bring you the fifteenth in a series of credit union podcasts from Robert McGarvey. Welcome to the CU 2.0 Podcast, regular interviews with credit union leaders, thinkers, movers, shakers and more. Talk to Cathie Mahon and it’s a fast ride into what mission makes a credit union […]

News Flash: Mobile Banking Apps Now Among the Most Used

By Robert McGarvey For Credit Union 2.0 The Citi 2018 Mobile Banking Study told us what we should already have known: consumers love a decent mobile banking app. And they use it a lot. How often? Citi said that mobile banking apps come in third, after only social media apps and weather. That’s based upon a survey […]

Consumers Say Boo To Your Digital Banking Products – Now What Do You Do?

By Robert McGarvey For Credit Union 2.0 The press release headline had me at go: “D3 Banking Technology Survey Finds More than Two-Thirds of American Digital Banking Users are Frust.” Nah, I didn’t know what “frust” means either. The Internet tells me a secondary slang meaning is frustrated. And, you bet, I too am frustrated with credit union mobile […]

Mobile Banking Rules – and Where You Still Stumble

By Robert McGarvey For CU 2.0 New research out of Javelin, sponsored by identity specialist Jumio, makes plain multiple facts and the central one is that digital banking rules and it does so across generations. It’s not just a Millennial thing anymore. Another key takeaway: most financial institutions – eyes on you – stumble in many key places, particularly in […]

Rating the Mobile Banking Apps: How Do Credit Unions Fare?

By Robert McGarvey For Credit Union 2.0 The good news for credit unions in this year’s MagnifyMoney survey of mobile banking apps: Many do very, very well, even against money center bank competition. The bad news: Mobile banking apps, suggests MagnifyMoney, “have reached middle age.” That means, per MagnifyMoney, “overall, apps haven’t appreciably improved.” They have entered an […]

Why MRDC Hasn’t Fulfilled Its Promise

By Robert McGarvey For Credit Union 2.0 A new research report from Javelin on “Why Digital Banking Often Fails to Reduce Offline Volume” has an infographic that just popped my eyes. The subject: “Reasons Why Consumers Avoid Mobile Banking and Turn to the Branch or ATM for Check Deposits.” Javelin offers answers but, first, why do […]